Women with higher education know as little about personal finance as men with a primary school education

Women know significantly less about money, loans, and savings than men, according to a new study. The situation is worst among young women in their 20s. Researchers are concerned.

Norway is one of the world's most equal countries when it comes to gender. Nevertheless, women do not know that much about private finances.

Ironically, Norwegians are among the best in the world in terms of financial competence.

“But this only applies to Norwegian men,” economics professor Ellen Katrine Nyhus said during the Kåkånomics conference in late October.

Gender differences are actually greater in Norway than in many other countries.

Nyhus presented the results from her survey at the conference.

“The findings are surprising in many ways,” she said. Nyhus is a professor at the University of Agder’s (UiA) School of Business and Law.

Norwegian men have high financial competence

The report is based on two surveys from 2018 and 2022.

In total, participants answered 56 per cent of the questions in the first test correctly. Men answered 62 per cent correctly.

Women answered only half of the questions correctly.

“A difference of 12 percentage points is significant and surprised me a little,” Nyhus said.

But this aligns with findings from a previous international survey carried out by the OECD. It shows that Norwegians are among the best in the world in terms of financial proficiency.

“But a closer examination of the figures reveals that it's the men who are responsible for Norway’s good results,” Nyhus said.

Norwegian women's results were similar to the average for all the countries that took part in the OECD survey. This means they are lagging behind when it comes to what they know about economics and finance.

Men know more about savings and loans

The knowledge gap between Norwegian women and men is greatest when it comes to topics such as savings, investment, inflation, and mortgages.

Only when it comes to questions about payments and bank accounts do women answer correctly almost as often as men.

The survey was conducted with a representative sample of the Norwegian population in terms of age, gender, and region.

Young women know the least

The gender differences in knowledge are greatest among the youngest age groups. Young women between 18 and 30 years old know the least about money.

The level of knowledge increases with age up to the 45-to-59 age group, who know the most. In this group, there is also the least difference between genders.

“This was very surprising. I had expected that older women who may not have been active in the workforce would have poorer knowledge,” Nyhus said.

She finds it concerning that the youngest women know the least.

“Young adults have to make many big financial decisions. It's an advantage to have a solid base of knowledge,” she said.

Men with vocational training outperform academic women

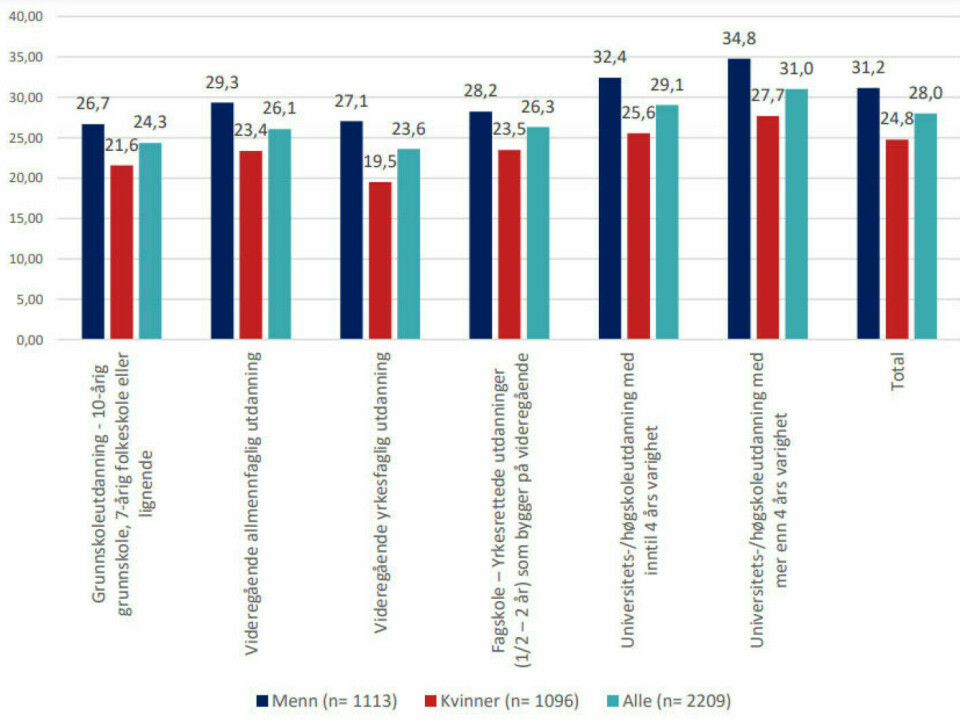

People with more than four years of higher education knew the most about money. This was true for both genders. The gender difference was smaller among those with higher education.

Those with up to four years of higher education were the next most knowledgeable.

Those who knew the least had either only a primary school education or vocational training.

“Knowledge increases with higher education. But the gender differences did not disappear,” Nyhus said.

Women with higher education had approximately the same level of knowledge as men with only a primary school education or a vocational background.

Geographically, there were small differences.

Are women too modest?

Far more women than men answered 'don't know' to questions about finances in 2018. This is a significant reason for the lower number of correct answers among women.

This may be because they actually know less or underestimated their own knowledge.

“Is it possible that women are less confident than men, and actually have more knowledge than they think? We wanted to investigate that," Nyhus said.

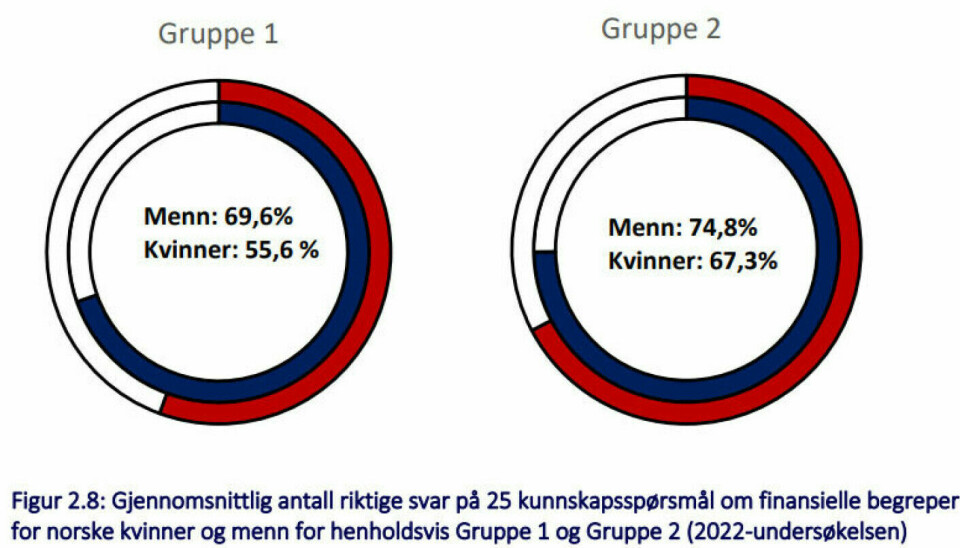

In the 2022 survey, researchers therefore divided the participants into two groups. One group was not given the opportunity to answer 'don't know'.

More participants answered correctly when they were not allowed to answer 'don't know'. The proportion of correct answers among both genders then rose from 62 per cent to 71 per cent.

This had a particularly significant impact on women.

Women answered correctly more often when they were 'pressured'

Women answered just over half of the questions correctly if they were allowed to answer ‘don't know’. Among the women who were not allowed to answer ‘don't know’, the proportion of correct answers increased to 67.3 per cent.

“Correct answers increased by 12 percentage points. This suggests that it’s partially correct that women underestimate their own knowledge,” Nyhus said.

Men also increased their correct answers. But not nearly as much as the women did.

Women answered 67 per cent correctly, while men answered 75 per cent correctly when the 'don't know' option was removed — a difference of 8 percentage points.

Lower self-esteem explained only a third of the gender differences.

"Women, on average, have slightly weaker knowledge of personal finance," Nyhus said.

These gender differences in financial knowledge are average figures. There are women and men at both the top and bottom of the scale, she clarified.

———

Translated by Nancy Bazilchuk

Read the Norwegian version of this article at forskning.no

Reference:

Nyhus, E.K. Finansiell kunnskap I den norske befolkningen (Financial knowledge in the Norwegian population), Report, June 2023.

Nyhus, E.K. Forskjeller i finansiell kunnskap og atferd blant norske kvinner og men (Differences in financial knowledge and behaviour among Norwegian women and men), Kåkånomics, 27 October 2023.